Cash Management When Cash Matters

We have all experienced this. The account balance is running lower than expected and bills are piling up. Often, we feel like we have no control over the situation. There is a helplessness. That’s when cash matters! DoubleCheck makes it easy to manage your cash at that very moment in time.

How It Works

DoubleCheck

in 60 seconds.

A lot of things in life deserve a double check.

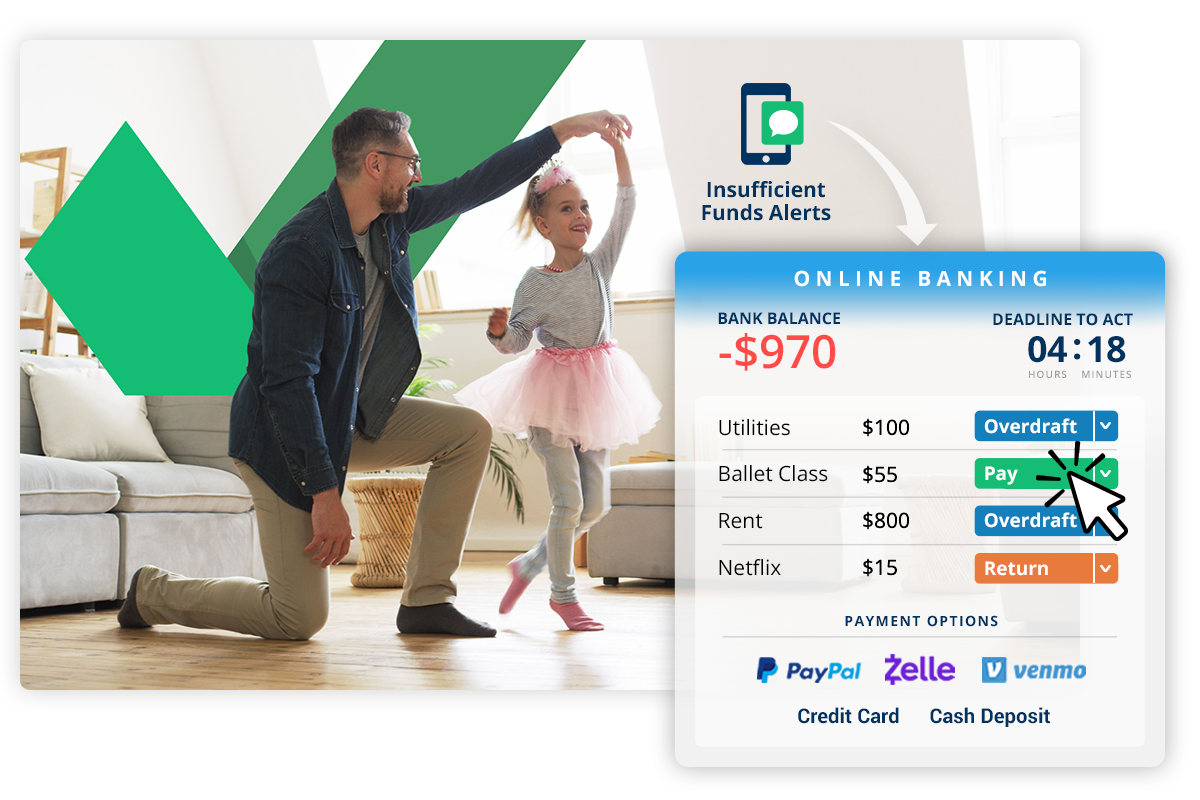

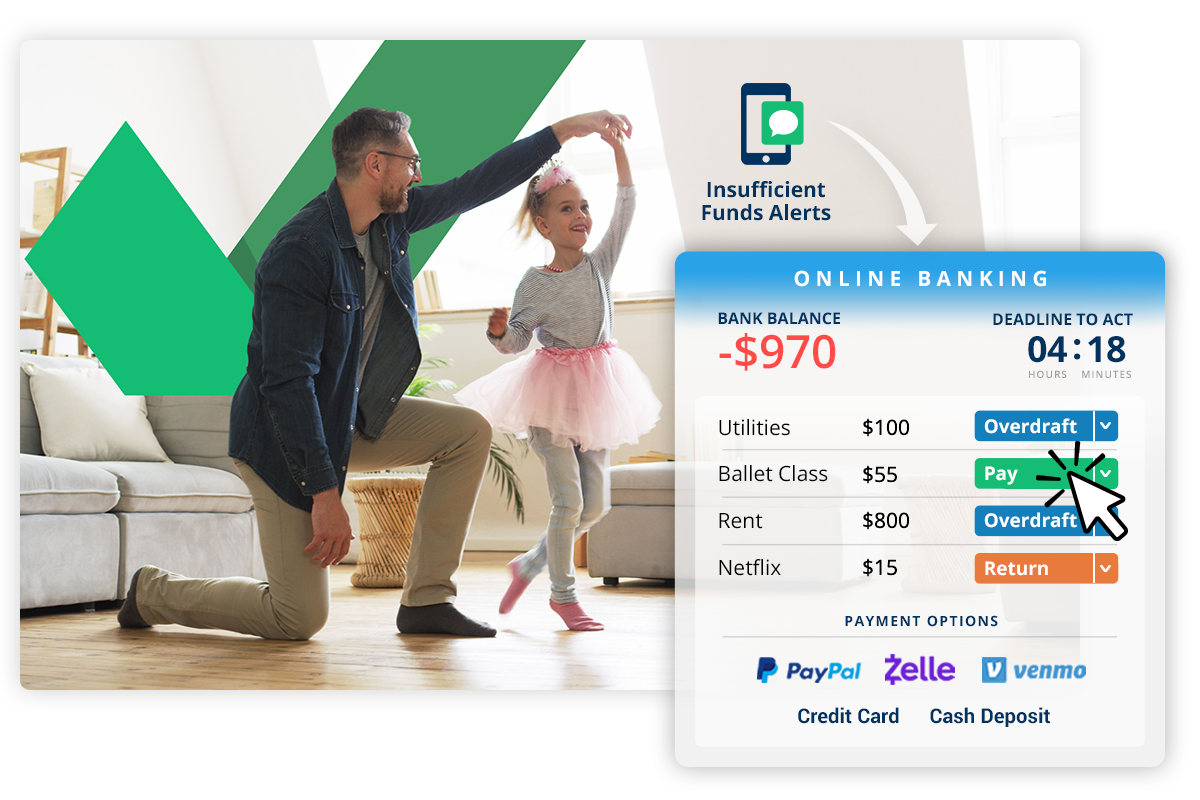

DoubleCheck notifies your account holders when they have insufficient funds and lets them determine what gets paid. With multiple payment options, they can make sure everything’s covered. They’ll avoid canceled services and secondary fees while keeping their reputation and credit intact.

Best of all, it takes just a few simple steps.

Know before you bounce

DoubleCheck sends alerts before a payment bounces and lets account holders decide how to proceed — providing them full control over the process.

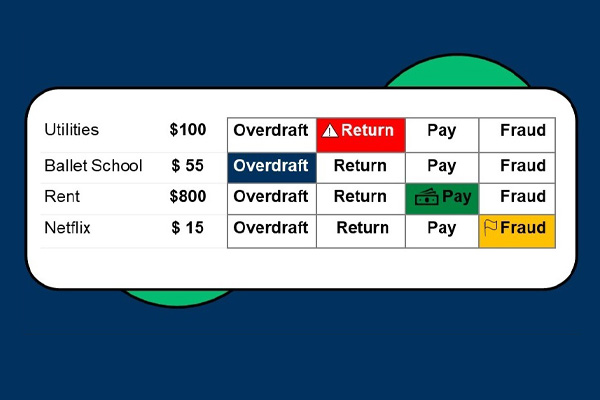

Pick who gets paid

Paying rent may more important than Netflix. Account holders get to choose which transactions are paid and which are returned – and help spot fraud.

Pick how they are paid

Account holders can add funds to their account to cover a shortage so nothing bounces. Move payment to credit card, use cash or a third-party payment service like Zelle or Paypal. Their mom can even spot them.

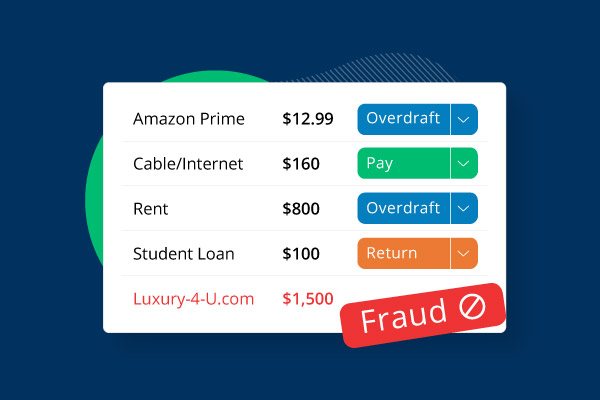

Fraud, begone!

Hmmm… that $1,500 doesn’t seem right. Account holders can spot fraud and notify their financial institution in a way that’s consistent with existing fraud processes.

Don’t end up

serving a $100 latte.

That $5 latte could cost a consumer more than a bottle of champagne if it ends up making them bounce their gas company payment. Bank fee + their gas company’s late payment fee + their bank’s fee = an expensive problem.

Keep

reputations clean.

All of your commercial and consumer account holders can keep this all confidential. By paying an item before it’s returned, they can avoid embarrassing situations, uncomfortable conversations and a bad credit rating.

We help you

avoid havoc.

We give account holders the information they need and the control they crave to prevent bounced payments from wreaking havoc on their finances, lives, and businesses.

A better option for banks and credit unions.

DoubleCheck can help you keep legislation, litigation, fraud and overhead issues in check—all while keeping your revenue healthy and empowering account holders to make their own financial choices. Make representment fee problems a relic of the past.

In the News

From profiting off overdrafts to preventing them: How FIs are evolving their revenue models

Here DoubleCheck, a B2B2C firm, steps in to fill the overdraft fee gap with protection and transaction management for FIs and their customers via integrations.

Fintech Trailblazer DoubleCheck Appoints New CEO

Austin, TX, January 23, 2025 – DoubleCheck announced today the appointment of Ashwin (“Ash”) Rangan as its new chief executive officer. Rangan...

Jack Henry Announces Winners of Inaugural Cobalt Awards: New awards celebrate innovation, community dedication, and commitment to financial freedom

Monett, Mo., October 9, 2024 – Jack Henry™ (Nasdaq: JKHY) is pleased to announce the recipients ofits inaugural Cobalt Awards. Launched earlier this...